Affordable USA Rental Vehicle Insurance Protection is essential when agents start upselling costly policies. The cost and complexity of renting a vehicle can increase quickly. However, with low-cost rental insurance strategies in the USA, including USA rental vehicle insurance protection, you can drive with confidence and save money.

USA Rental Vehicle Insurance Protection. However, by employing low-cost rental car insurance protection techniques in the USA, you can drive with confidence and save money. In the US, your credit card or personal auto insurance often covers rentals. Before spending $30 to $40 a day for the rental agency’s coverage, compare choices including third-party policies and travel insurance add-ons. This book outlines various types of rental insurance, reasonably priced solutions, and cost-cutting techniques to help you stay secure.

Affordable USA Rental Vehicle Insurance Protection Basics

USA Rental Vehicle Insurance Protection: You will be presented with a number of add-on policies when renting a car. The Loss Damage Waiver (LDW) or Collision Damage Waiver CDW) is the primary one. If the car is damaged, this waiver, which isn’t really insurance, allows you to avoid having to pay a high deductible.USA Rental Vehicle Insurance Protection

It may cost between $30 and $40 a day. For instance, a CDW “will cost an additional $30 to $40 per day on top of the rental,” according to NerdWallet. Additionally, rental companies offer Personal Effects Coverage (PEC) for stolen property, Personal Accident Insurance PAI for medical expenses, and Supplemental Liability Insurance (SLI) to increase liability limits.USA rental vehicle insurance protection

Most people don’t need these extras if they already have insurance. If your personal auto policy includes comprehensive and collision coverage, it will typically cover any damage to a similar rental car. Also, liability insurance from your auto policy covers injuries or damage you cause to others while driving a rental. In short, your own insurance often functions like “full coverage for rental cars,” letting you decline the rental’s expensive insurance. USA Rental Vehicle Insurance

Check Your Current Coverage First?

Understanding the importance of USA rental vehicle insurance protection can save you from unexpected expenses during your trip.

Personal Auto Insurance. USA Rental Vehicle Insurance in which a rental car company must provide the minimum amount of liability insurance for their renters. But if you have full auto coverage (comprehensive + collision), such coverage typically applies to rentals of an equivalent value. For example, New York’s Insurance Department says that New York drivers insured under an auto policy need not purchase CDW on a rental for up to 30 days anywhere in the U.S.

Or Canada. Similarly, according to consumer watchdogs: “If you carry your own car insurance, and if it covers injuries caused by a car accident (most do), you don’t need PIP because anyone injured while riding in your car is already covered through that auto insurance.” And while comp/collision would cover the damage if it’s on your policy. USA Rental Vehicle Insurance.

Credit Card Rental Insurance. Some major credit cards (such as Visa, MasterCard, American Express and more) offer automatic rental car insurance protection if you pay for the car with that card. These include collision insurance and theft coverage, so long as you reject the CDW (collision damage waiver) offered by the rental company and use the card to pay for your rental.

Coverage is typically secondary (your auto policy pays out first, and then the card picks up any remainder). Some premium cards even feature primary coverage (they pay out first). American Express Platinum offers $100,000 in primary coverage for only $25 on a rental. You should always call your issuer to confirm the terms and make sure the coverage dovetails with what you need.

Cheap Rental Car Insurance Alternatives?

If you lack sufficient coverage or want extra peace of mind without high costs, consider these budget-friendly options: USA Rental Vehicle Insurance Protection

-

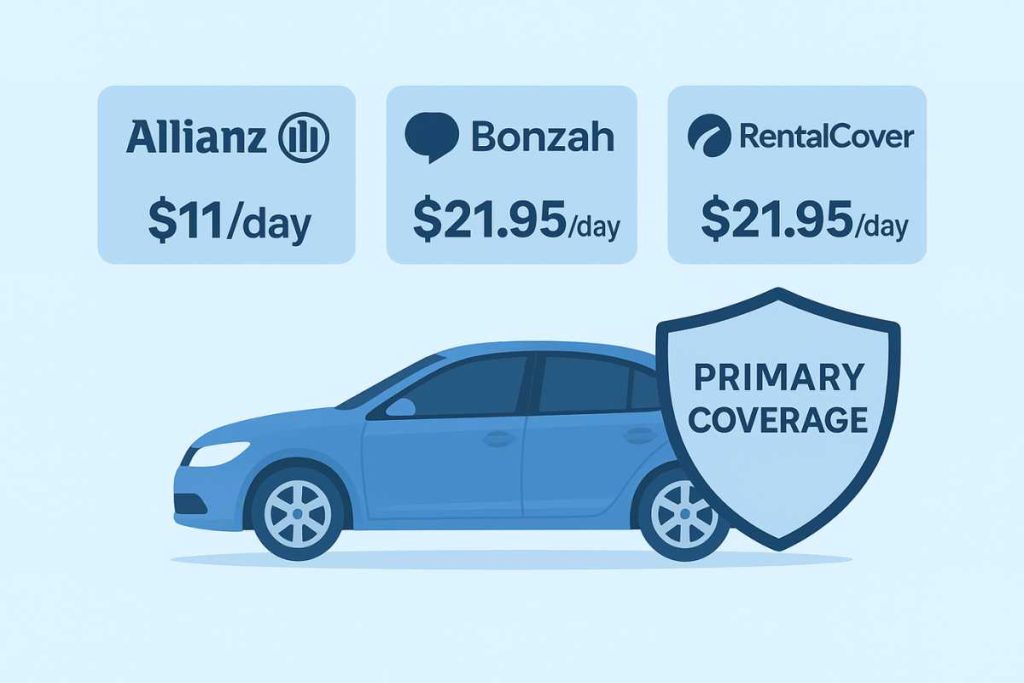

Standalone Third-Party Policies. Insurers, including Allianz, Bonzah and RentalCov, er sell rental insurance online. USA Rental Vehicle Insurance NerdWallet states that the Allianz OneTrip Rental Car Protector costs around $11/day (with up to $50,000 in coverage), and Bonzah offers plans beginning at $21.95/day (with up to $35,000. They’re commonly primary coverage (you get paid before your auto insurer) and often provide 24-hour assistance. RentalCover says its no-deductible plans can sometimes cost up to per percentage less than those offered at the rental counter. These independent plans can be a money saver, particularly for longer rentals or overseas travel.

-

Travel Insurance with Rental Coverage. There are various trip insurance policies available with an option to add rental car coverage (Collision Damage Waiver). As the travel guru Rick Steves describes, one option is to obtain “collision insurance as part of a larger travel-insurance policy.” That means that you need to ensure your entire trip (flights, cancellation, medical, etc.) and add rental car coverage in a single plan. It can also be cheaper compared with purchasing both travel insurance and rental insurance individually.

- Pay Now/Prepaid Insurance. At times, booking sites or rental companies provide a “pay now” option for CDW coverage that is fractionally cheaper than purchasing at the counter. This is not a different insurer, but if you pay in advance only, you may save a few dollars per day as compared to the airport kiosk price. As always, compare prices and make sure the coverage is identical. USA Rental Vehicle Insurance.

- Credit Card Upgrades. You might also consider applying for a premium travel card that does include primary rental insurance as a benefit, if your current credit cards only offer secondary coverage. Hunt for deals from the major issuers and consult sites such as NerdWallet and Kiplinger for the latest cards carrying strong USA Rental Vehicle Insurance Protection perks.

Look at all of these USA rental car insurance choices before you go. In most cases, such alternatives offer the same protection, but at a small fraction of what you’ll pay at the rental desk.

Rental Insurance Costs & Comparison Table?

Rental insurance costs vary widely. At the counter, a CDW/LDW typically ranges from about $15–$40 per day. For example, a consumer report found CDW runs about $26.99–$33.99/day depending on the company. Adding Supplemental Liability or Personal Accident can nearly double your daily insurance bill. In contrast: USA Rental Vehicle Insurance Protection

| Coverage Source | Collision Damage | Liability | Other Notes |

|---|---|---|---|

| Personal Auto Insurance | Covered if you have comp/collision(deductible applies) | Covered up to policy limits |

Responsibility, damage to third-party vehicles and injuries are paid for. No extra USA Rental Vehicle Insurance Protection. |

| Credit Card Insurance | Usually covered (secondary, often no deductible) | Not covered (some cards offer LIABILITY only in rare cases) |

Must pay with that card. Secondly, means your auto insurance has to pay first . |

| Rental Company Insurance | CDW/LDW covers damages (waives the rental company’s deductible | Basic liability (state minimum) included; SLI boosts limits (for a fee) | Very convenient but costly (~$20–$40/day) |

| Third-Party (Allianz, etc.) | Primary coverage for damage (up to $35K–$100K) | Generally not applicable (focus on vehicle damage) | Cheaper (e.g. ~$11/day) and primary (no claim on personal policy |

| Travel Insurance Add-On | Often offers collision coverage (check policy terms) | Usually includes liability up to standard limits |

Offers more coverage (cancellation, medical) outside of the car, but requires the entire trip to be purchased. . |

This table highlights how using your own insurance or a credit card can cover the rental at little to no extra cost, whereas buying coverage from the rental company is very expensive in comparison. USA Rental Vehicle Insurance

Tips for Getting the Best Deal?

-

Decline Duplicate Coverage: If your policy covers rentals, politely refuse CDW/LDW at the counter. Save those dollars.

-

Use Credit Card Benefits: Charge the rental to a card with USA Rental Vehicle Insurance Protection. Confirm coverage with the issuer first. Even secondary coverage can save you 30+ dollars per day.

-

Buy Standalone Early: If you need extra protection, purchase third-party insurance before your trip. It’s often cheaper and can be purchased only for the exact rental period.

-

Document the Car Condition: Always take photos of the rental car from all angles before leaving the lot. This can protect you from bogus damage claims (good practice mentioned by a consumer expert.

-

Shop and Compare: Check aggregator sites or rental extras when booking. Some booking platforms offer insurance add-ons at lower rates. Also, compare auto insurer and credit card benefits online before making a decision.USA Rental Vehicle Insurance Protection

Pros & Cons of Rental Insurance Options?

-

Using Your Auto Insurance:

- Pros: No extra daily cost (you already paid premiums). Covers liability and collision, just like your own car. Easy to claim on your auto policy.

- Cons: You pay your deductible and potentially higher premiums if you file a claim. Not useful if you don’t have comp/collision. Does not cover personal items in the car.

-

Credit Card Coverage: USA Rental Vehicle Insurance Protection

- Pros: Usually a free benefit if you book with the card. Many cards offer zero-deductible, primary coverage (meaning no claim on your auto insurance). Convenient and can save upfront cost.

- Cons: Often secondary coverage (except some premium cards may have exclusions (e.g., certain countries, vehicle types). You must pay the full rental on the card.

-

Rental Company Insurance:

- Pros: Comprehensive and simple. If purchased, you don’t pay any damage (with CDW, beyond a smaller waived deductible) and usually have immediate support. No claims hassles with personal insurers.

- Cons: Extremely expensive. Can add $20–$40 per day or more. Often redundant if you have other coverage. Sales agents can pressure you into buying.USA Rental Vehicle Insurance Protection.

-

Third-Party Insurance Plans:

- Pros: Cheaper alternative (often under $20/day). Primary coverage means no claim on your auto insurance. Many include extra perks (flat tyre, keys). Can be bought on demand.

- Cons: You must handle a separate claim with them if damage occurs. Not all are available for all countries or vehicle types. Make sure to decline the rental’s coverage to use it.

-

Travel Insurance Add-Ons:

- Pros: Bundles rental protection with trip cancellation/interruption, medical, and baggage cover. It could be a good deal if you need all those protections anyway.

- Cons: More expensive upfront (you pay for full-trip insurance even if you mostly want rental coverage). Policies vary – always read the fine print on the rental coverage limit.

Key Insights

-

Check Your Existing Coverage: Most Americans have rental coverage included in their auto policy or credit cards.USA Rental Vehicle Insurance Protection

-

Avoid Expensive Add-Ons: Rental counter insurance can add hundreds of dollars to your tripIt’s often needless duplication.

-

Credit Cards Can Save You Money: Many cards offer free CDW coverage. In fact, American Express covers up to $100k for just $25 per rental.

-

Shop Around: Third-party insurers (Allianz, Bonzah, etc.) can cut costs dramatically. Allianz’s plan is only $11/da.y

-

Document Everything: Take photos of the rental car’s condition. A quick habit that prevents disputes and ensures your affordable insurance actually protects you.

Frequently Asked Questions

Q: Is rental car insurance required in the USA?

A: There is no federal law that says you must purchase rental insurance, USA Rental Vehicle Insurance Protection, but rental agencies are required to offer state-minimum liability coverage. You need supplemental coverage only if your personal insurance is limited or you want a deductible waived. The majority of US drivers have liability (and usually collision) on their own insurance policy, which is automatically applicable to rentals.

Q: What does a Collision Damage Waiver (CDW/LDW) cover?

A: A CDW is for the rental car itself if it’s damaged or stolen. It will not cover injuries you sustain or damage you cause to others. That means the CDW serves as something akin to comprehensive collision insurance for the rental, waiving the rental company’s right to recover its deductible. Put another way, it’s essentially like the collision/comprehensive aspect of full auto insurance

Q: Will my auto insurance cover a rental car?

A: Yes, if you have comprehensive and collision coverage on your policy, it will typically cover damage to a rental car (usually up to the value of your own vehicle). Your standard liability coverage will cover damage or injuries you cause to others in an accident, even in the rental. Always check with your insurer, but for U.S./Canada rentals, it’s common for your policy to apply without additional cost

Q: How does credit card rental insurance work?

A: Most major credit cards include rental car insurance if you use the card to pay for the rental. If you have coverage, you can usually decline the rental company’s CDW. Cards often provide secondary coverage (your insurance pays first, then the card covers the rest). Some premium cards (e.g., certain Visa or Amex) offer primary coverage, meaning the card’s insurance pays out first. Terms vary by card, so contact your issuer before travelling.USA Rental Vehicle Insurance Protection

Q: What is the cheapest way to insure a rental car?

A: USA Rental Vehicle Insurance Protection. The cheapest way is to rely on coverage you already have and only buy additional insurance if truly needed. Decline the rental’s CDW if you have auto insurance or a credit card benefit.

If you do need extra protection, buy third-party rental insurance online before your trip (often $10–$20/day) or add a short-term travel insurance policy that includes rental coverage. Prepaying for insurance or using a travel insurance bundle can also be cheaper than on-the-spot rental counter prices.USA Rental Vehicle Insurance Protection

Final Summary

Do It Yourself Summary: USA Auto Rental Insurance Protection, and the answer is, affordable rental vehicle insurance protection begins first thing with what you have. Most travellers will find that their own auto insurance or credit card,

in many cases, covers rentals, so there’s no need to pay the rental company for a redundant policy. For an added layer of protection, consider inexpensive third-party plans (including one from Allianz for $11/day or travel insurance.USA rental vehicle insurance protection

By knowing your options and being shopping savvy, you can leave knowing you’re secure without overpaying. Be sure to take some snapshots of the condition of the car, hold onto those insurance terms whenever you use insurance and share these tips so that others can also receive budget-conscious rental car coverage!