A car under a protective umbrella symbolises the security of car insurance coverage, highlighting how State Farm car insurance quotes can help you find the proper protection. State Farm car insurance quotes give drivers a quick estimate of their auto insurance premiums and coverage options. Getting a quote lets you compare premiums and coverage plans. Uncover discounts and understand the factors that affect your rate.

This guide explains how State Farm calculates premiums, how to obtain quotes online or through an agent, and strategies to save on your policy. We’ll also cover regional considerations (Florida, Texas, Ohio, California, Pennsylvania, Georgia) and even classic car policies. State Farm Car Insurance Quotes.

Why Get State Farm Car Insurance Quotes?

Getting multiple quotes, including State Farm car insurance quotes, lets you shop smart. Comparing rates ensures you pay a competitive price for the coverage you need. Reasons to get a quote from State Farm include:

- Compare Premiums: Understand how State Farm’s price stacks up against other insurers for similar coverage.

- Customise Coverage: Quotes allow you to tailor coverage (liability, collision, comprehensive, etc.) to find the best fit.

- Verify Discounts: See how bundling or safe-driving discounts reduce your premium.

- Plan Your Budget: Knowing your estimated premium in advance helps you plan finances and avoid surprises.

- Local Agent Support: State Farm quotes connect you to nearby agents who can explain options and provide personalised advice. State Farm Car Insurance Quotes.

By starting with State Farm car insurance quotes — whether on State Farm’s site or with an agent — you lay the foundation for affordable, adequate coverage. State Farm’s own data shows customers who switch can save an average of $694 per year, so getting a competitive quote is key. Below, we break down how premiums are set and how to request your quote.

Factors Influencing State Farm Auto Insurance Premiums?

State Farm calculates your auto insurance premium by estimating the expected cost of future claims. Numerous factors play into the quote you receive. Key factors include:

- Driver Age and Experience: Younger drivers (under 25) and older drivers (65+) typically pay higher rates. Teen drivers often see exceptionally high quotes.

- Location and ZIP Code: Living in urban or high-traffic areas generally increases premiums. State Farm notes that drivers in congested cities and regions with higher accident rates pay more. For example, Texas cities like Houston and Dallas experience severe congestion, resulting in slightly above-average rates.

- Driving Record and History: Tickets, accidents, DUIs, or license suspensions raise quotes. A clean record earns you better rates.

- Claims History: Past claims on any policy can indicate risk; multiple past claims often bump up premiums.

- Annual Mileage: The more you drive, the higher the risk. Low-mileage discounts may apply if you drive only a little each year.

- Vehicle Make, Model & Safety: Expensive cars, high-performance models, or cars with poor safety ratings cost more to insure. State Farm will consider your car’s value and repair costs.

- Coverage and Deductibles: Higher coverage limits and lower deductibles increase the premium. Choosing basic liability-only coverage yields a low quote, while complete coverage (collision + comprehensive) raises it.

- Credit and Insurance Score: In many states, insurers use credit-based insurance scores to adjust quotes. (Note: Some states, like California, restrict credit rates)

- Discounts and Programs: Safe-driver programs (like Drive Safe & Save), multi-policy (bundling) discounts, good student discounts, defensive driving courses, etc., can reduce your premium.

For example, State Farm’s Drive Safe & Save program lets drivers earn discounts by safe driving – it can lower premiums by up to 30%. Bundling your auto policy with renters or homeowners insurance through State Farm also pays off: customers saved an average of $834. State Farm Car Insurance Quotes.

Factors at a glance:

- Age, gender, marital status (acts through state laws)

- Location (zip code) and urban vs. rural setting

- Driving record (tickets, accidents) and credit/insurance score

- Vehicle type (cost, safety features) and usage (miles driven)

- Coverage levels chosen and deductibles

- Available discounts (bundling, safety programs, student, etc.)

Understanding these factors helps you see why one driver’s State Farm car insurance quote may be different from another’s. Now, let’s discuss how actually to obtain a quote.

How to Get a State Farm Car Insurance Quote?

Getting your State Farm car insurance quote is simple and can often be done online for free. To ensure accuracy and speed, follow these steps:

- Gather Information: Prepare details about your vehicle and driving history. State Farm recommends having your car’s make, model, year, mileage, and any recent driving violations ready. For example, have on hand: vehicle year/make/model, VIN or body style, current mileage, and your driver’s license numbers. You’ll also need your date of birth and any accident/ticket history.

- Visit the State Farm Website: Go to StateFarm.com and select Car Insurance > Get a Quote. Enter your ZIP code, then fill out the online form. The site often prompts for basic information (ZIP code, vehicle details) to generate a preliminary quote.

- Use the Online Quote Tool: State Farm’s portal will guide you through coverage options (liability, comprehensive, etc.) and discounts. It may suggest adding State Farm’s driver safety or car safety programs. The instant quote tool typically asks a few questions to refine the quote.

- Contact a State Farm Agent (Optional): If you prefer personal assistance, use the agent locator on the site. Providing the same information to an agent, whether by phone or in person, yields a quote. Agents can explain coverages and help adjust your quote by adding discounts.

- Compare & Review: Once you have your State Farm quote, consider getting quotes from other insurers as well. But focus on State Farm’s quote details: what coverages and deductibles are included, and what discounts were applied.

State Farm emphasises a “Get an affordable car insurance quote” approach on its site. The quotes are free and binding only when you buy, so that you can experiment with coverage choices without cost. In fact, the site explicitly encourages visitors to “Get an affordable car insurance quote”, highlighting how customers often save when they switch.

Quick Quote Options: State Farm’s mobile app and some third-party marketplaces also provide quick online quote tools. You may see ads or partners like Coverage.com offering State Farm quotes. Always double-check these for accuracy by verifying with State Farm directly. State Farm Car Insurance Quotes.

State Farm Car Insurance Quotes Online?

Because the world is digital, most drivers use State Farm car insurance quotes online. On State Farm’s website, the online quoting tool is straightforward and updates quotes in real time as you enter information. It’s free and quick: enter basic driver info and vehicle data, and you’ll get an instant estimate.

This is often called a “quick quote.” If you need a State Farm car insurance quick quote, look for the online “Get a Quote” button and fill in the prompts.

Getting an online quote is especially convenient if you want to compare multiple scenarios (e.g., raising your deductible or adding coverage) before calling an agent. You can also get free quotes via State Farm’s customer service phone line, though online is faster. Remember that factors like coverage limits and add-ons affect the quote, so adjust them in the tool to see how the price changes.

Steps to a Free Quote

- Use the “Quote” tool on State Farm’s site or mobile app.

- Enter zip code, driver’s license, and vehicle info.

- Choose coverages (liability limits, deductibles, extras) and apply any discounts.

- Review the free quote summary, which includes your estimated premium.

State Farm also offers a paperless eQuote option for customers with an existing relationship: an agent can email you a quote link. In any case, requesting multiple quotes (e., for different drivers in a household) is quick and can save money. Car insurance quotes State Far.m

State Farm Car Insurance Quotes by State?

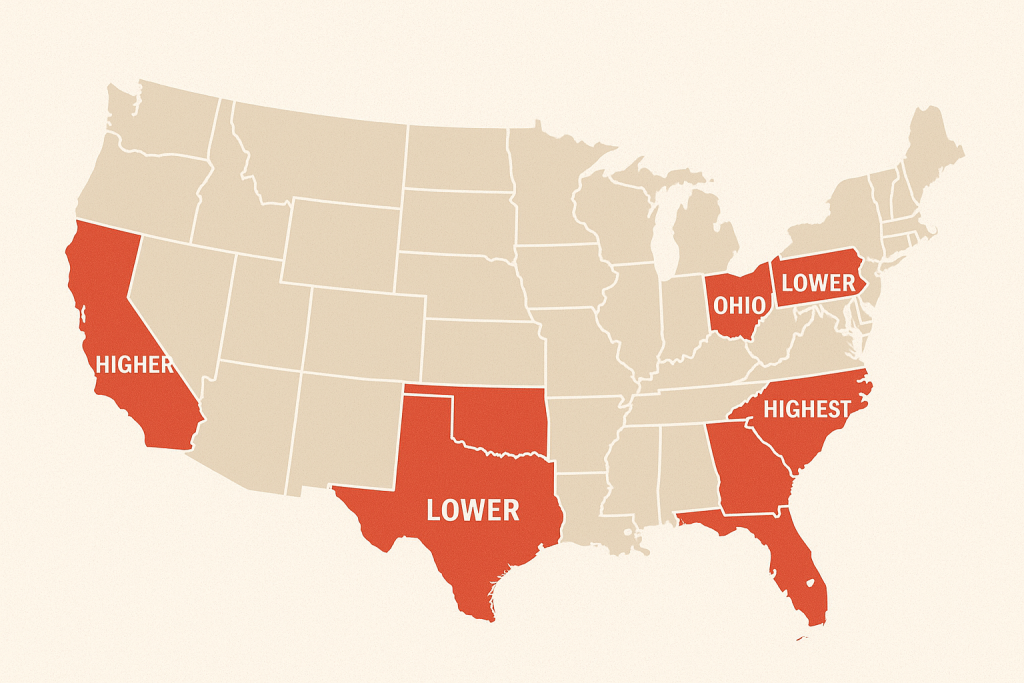

Insurance premiums can vary significantly from state to state. Below are examples of how State Farm car insurance quotes might differ by location, based on average premiums and common factors in each state:

- Florida: Florida’s auto insurance market is among the most expensive in the U.S. State Farm has High rates of uninsured drivers, frequent hurricane claims, and insurance fraud drive up costs. A State Farm car insurance quote in Florida will likely be higher than the national average for the same coverage, reflecting these risk factors. Drivers often benefit from flood and uninsured motorist coverage in Florida auto insurance quotes. State Farm Car Insurance Quotes.

- Texas: Texas drivers pay about 2% more than the national average for full coverage. Cities like Houston and Dallas experience heavy congestion and high theft rates, which contribute to higher premiums. State Farm car insurance quotes in Texas will consider Texas’s legal requirements and these urban factors. Texas also has variable minimum liability laws that can affect quotes.

- California: California’s full-coverage insurance runs roughly 16% higher than the national average. Reasons include high cost of living, congested freeways, and strict regulations (for example, insurers cannot use credit scores in California). A State Farm car insurance quote in California often reflects high potential claim costs. Be aware that California requires more coverage (higher liability limits than many states).

- Ohio: Ohio’s insurance rates tend to be below the national average. The average full coverage policy in Ohio is about $1,842/year. State Farm car insurance quotes in Ohio are influenced by Ohio’s moderate driving environment and lower theft rates. However, urban centres like Cleveland or Columbus can push specific quotes higher.

- Pennsylvania (PA): Pennsylvania drivers pay about 8% less than the U.S. average. PA has relatively low uninsured driver rates, which keeps costs down. State Farm car insurance quotes in PA reflect these savings. Drivers in Pennsylvania typically see more modest premium quotes, and they must choose tort options (full vs. limited tort), which also affect rates.

- Georgia (GA): Full Coverage costs an average of $2,895 per year. This is slightly above the national full-coverage average. State Farm car insurance quotes in GA take into account Georgia’s weather (tornado/hail risk in parts of the state) and moderate accident rates. A good driver in Georgia may find quotes that compare favorably to these state averages.

When searching for quotes, remember that the ZIP code and the city within the state can significantly change the quote. A suburban area might have lower State Farm quotes than a busy metro area in the same state. Always enter your precise location for an accurate quote.

Tips to Lower Your State Farm Premium?

- Bundle Policies: Insure more than one item (auto + home or renters) with State Farm. Bundling can save hundreds; State Farm cites up to $834 in annual savings by bundling auto with renters/home.

- Increase Your Deductible: Choosing a higher deductible reduces your premium. If you can afford a $500 or $1,000 deductible instead of $250, your quote will drop.

- Stay Claim-Free: Avoid small claims. Each claim can raise your future quotes. Safe driving keeps premiums lower.

- Use Safe Driving Programs: Enrol in State Farm’s Drive Safe & Save program. Driving a connected device or enabling telematics can earn you significant discounts (up to 30% off).

- Maintain Good Credit: In states where credit matters, a strong credit profile can lower premiums. Check if your state allows it.

- Drive a Safe Car: Safety features (airbags, anti-theft, good crash ratings) can reduce your quote. Consider these if you have a choice in vehicles.

- Take Defensive Driving Courses: State Farm offers discounts for completing approved driver education or defensive driving courses. Ask your agent about availability.

- Review coverage yearly: After a few years, check whether removing excess coverage or reassessing vehicle value lowers your rate. Also, check whether usage patterns changed (e.g., driving less for work).

- Maintain Continuous Coverage: Gaps in insurance history can increase quotes. Keeping continuous coverage shows consistency.

Even after receiving your quote, you can take steps to reduce your premium before buying a policy. Here are practical tips tailored to State Farm policies:

By applying these tips along with the State Farm discounts (student good grades, military, etc.), drivers often find quotes well under initial estimates. Remember that each dollar saved in premiums translates to hundreds over a policy term. State Farm Car Insurance Quotes.

State Farm Classic Car Insurance Quotes?

State Farm also offers collector and classic car insurance for antique vehicles. If you have a classic or antique car, State Farm’s Classic Car Insurance (powered by Hagerty in many states) might be the best way to get coverage. Unlike regular car quotes, classic car premiums work differently:

- Agreed Value Coverage: State Farm determines an agreed-upon value for your classic car, not standard book value. You and your agent decide the car’s value, and that agreed value becomes your coverage limit. A higher agreed value yields a higher premium.

- Usage Restrictions: Classic cars must be driven infrequently (e.g., for shows or parades) to qualify. State Farm quotes for classic car insurance assume minimal annual mileage.

- Additional Benefits: Policies often include $0 deductible for agreed-upon total losses and coverage for spare parts up to $500. Your State Farm quote for a classic will reflect these features.

- Premium Factors: Condition, rarity, modifications, and storage all influence the quote. A perfectly restored show car may cost more to insure than one under restoration, depending on the agreed value.

For example, State Farm’s Classic+ program (in certain states) is tailored to collector vehicles. If you’re hunting for a classic car insurance quote, provide details on the car’s year, condition, and intended usage to your agent. Premiums are often very reasonable if the vehicle is kept in good shape and driven safely.

Classic car owners should always get a dedicated classic car insurance quote, since regular auto policies will not cover full values. In summary, a State Farm classic car insurance quote will take your car’s unique value into account and offer specialised coverage.

FAQs

Q: What information do I need for State Farm car insurance quotes?

A: To get an accurate quote, State Farm needs details about you and your vehicle. This includes your car’s year/make/model, current mileage, vehicle identification number (VIN) or body style, and where the car is garaged. Drivers will ask for your name, date of birth, driver’s license number, and your driving history (tickets or accidents). Having this info on hand will make the quoting process fast and precise.

Q: Are State Farm car insurance quotes free?

A: Yes. State Farm provides free car insurance quotes both online and through agents. You can use the online portal to get an instant quote at no cost, or call a local agent for a complimentary quote. Getting a quote does not obligate you to purchase; it simply provides an estimate of your premium.

Q: How do I get a quick State Farm car insurance quote?

A: For a quick quote, use State Farm’s website or mobile app. Enter your ZIP code, answer a few questions about your car and driving history, and you’ll get an estimate within minutes.

The online tool is designed for speed. Alternatively, you can call or visit a State Farm agent and mention you need a “quick quote,” which they can typically generate on the spot with your basic information. State Farm Car Insurance Quotes.

Q: How are State Farm car insurance quotes calculated?

A: State Farm (like other insurers) uses statistical models to predict claims cost based on factors in your profile. Age, location, driving record, car type, and coverage choices all feed into the rate. They then add administrative costs and margins to set your premium. Discounts (safe driving, bundling, etc.) are subtracted from the base rate. That final number is your quoted premium.

Q: Can I get State Farm car insurance quotes online?

A: Absolutely. State Farm offers online quotes through its official website. The online quoting system guides you through entering your information step by step. This way, you can compare coverage and price instantly, modify coverage, and even apply discounts in real time. You don’t need to call an agent unless you prefer personal assistance.

Q: What is included in a State Farm car insurance quote?

A: A quote from State Farm will show the premium for the coverages you selected, which typically include liability (bodily injury/property damage), collision, comprehensive, uninsured motorist, and any add-ons (rental reimbursement, roadside assistance, etc.). It will list your deductible choices and any discounts applied. The quote will break down costs per coverage, so you see precisely how your total premium is calculated.

Q: How can I save on State Farm car insurance?

A: Use State Farm discounts and safe driving. For instance, adding more policies (home or renters) can help you avoid driving under. Enroll in the Drive Safe & Save program, maintain a clean driving record, maintain good credit, and consider taking a defensive driving course.

Also, shop around every year – even an existing reasonable rate can sometimes be negotiated lower, especially if you demonstrate lower mileage or a recent accident-free streak.

Q: How do I get a classic car insurance quote from State Farm?

A: Contact a State Farm agent and mention you have an antique or classic car. They will gather details about your car’s value and intended use. State Farm will then provide a quote under its Classic Car program, which offers agreed-value coverage. Be ready to explain your car’s condition and any modifications, as these affect the agreed value and premium.

Conclusion

State Farm car insurance quotes give you the information you need to make an informed choice about coverage and cost. By understanding the factors that influence your premium and using the quoting tools or agents, you can find a policy that fits your needs. Remember to enter accurate details and ask about available discounts – State Farm offers many programs that could lower your premium. State Farm Car Insurance Quotes.

Whether you live in Florida, Texas, Ohio, California, Pennsylvania, Georgia, or elsewhere, getting and comparing State Farm car insurance quotes is the first step to securing the proper protection for your vehicle. Ready to find your rate? Get a free State Farm car insurance quote online or from an agent today, and take control of your auto insurance costs.

1 thought on “State Farm Car Insurance Quotes: Essential Tips to Lower Premiums”