Planning your budget? This guide breaks down the average USAA car insurance cost in 2025. USAA (United Services Automobile Association) offers some of the lowest auto insurance rates, especially to military members and their families.

We’ll show you how much you can expect to pay, what factors affect your premium, and how to maximise discounts. Along the way, we’ll compare USAA rates to national averages and rival insurers. By the end, you’ll know exactly how much USAA car insurance costs for your situation and tips to keep your costs down.

How Much is USAA Car Insurance?

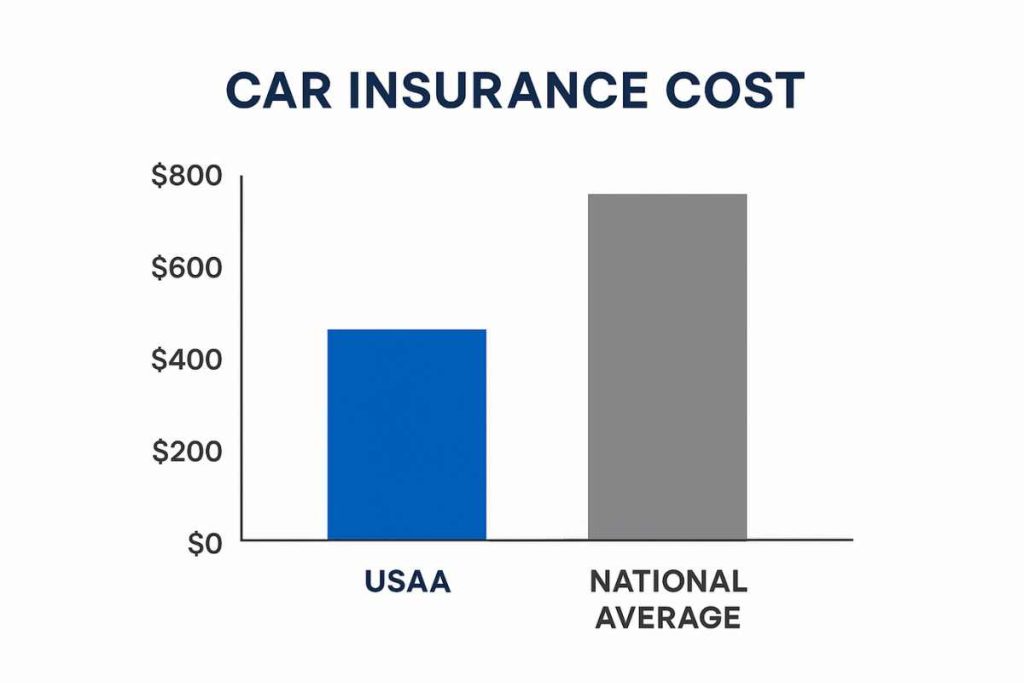

USAA’s average car insurance cost is typically well below the U.S. average. For example, The Zebra reports that a 6‑month full-coverage USAA policy averages about $835, versus ~$1,084 for the national average. In other words, USAA drivers pay roughly 30–35% less than typical insurers. In 2025, multiple analyses confirm this: NerdWallet’s research shows USAA’s full-coverage premium is around $125 per month ($1,499 per year), while AutoInsurance.

Com finds about $117 per month ($1,407/year)for a standard policy. Policygenius also notes a USAA full-coverage rate of $87 per month ($1,044/year) for a $50K/$10 liability policy, dramatically below the national average of $136/month. Overall, expect the average USAA car insurance cost to be in the low hundreds per month for full coverage, with minimum-liability plans running much lower.

The table below summarises typical USAA premiums by scenario (full vs. minimum coverage, with violations, etc) average USAA car insurance cost

| Coverage Scenario | USAA Annual Premium | USAA Monthly Premium |

|---|---|---|

| Full coverage (standard) | $1,407 | $117 |

| Minimum (liability only) | $417 | $35 |

| With a speeding ticket | $1,747 | $146 |

| After an at-fault accident | $2,194 | $183 |

| After a DUI | $2,916 | $243 |

| Poor credit history drivers | $2,511 | $209 |

| Senior drivers (clean record) | $1,358 | $113 |

| Young drivers (clean record) | $2,048 | $171 |

These estimates come from USAA’s own data and industry analyses. For instance, USAA notes that young drivers pay about $171 per month on average, while seniors pay just $113/mo. As the table shows, adding violations or poor credit can raise your USAA premiums by dozens of dollars each month.

In general, USAA’s rates are substantially cheaper than major competitors. For context, the U.S. national average full-coverage premium is roughly $220 per month ($2,638/year), so USAA often undercuts that benchmark. Average USAA car insurance cost

Comparison: USAA vs. Other Insurers?

Below is a quick comparison of average annual premiums for a standard full-coverage policy with several insurers. USAA’s rate is significantly lower than many national carriers:

| Insurance Company | Full Coverage Annual | Full Coverage Monthly |

|---|---|---|

| USAA | $1,499 | $125 |

| Travelers | $1,712 | $143 |

| GEICO | $1,985 | $165 |

| State Farm | $2,090 | $174 |

| Progressive | $2,158 | $180 |

As shown, USAA’s average premiums (for eligible members) are among the lowest in the industry. In fact, USAA consistently ranks as one of the cheapest insurers in national surveys. The major caveat: USAA membership is restricted to military personnel, veterans, and their families. So while a civilian average might not qualify, eligible drivers enjoy these low rates.

Factors Affecting Your USAA Car Insurance Premium?

USAA’s pricing, like any insurer, depends on many factors. Understanding them lets you anticipate costs and find savings. Key factors include: average USAA car insurance cost

-

Driving Record: Clean drivers pay much less. USAA specifically notes clean drivers may pay about $87–$117/month, while a single speeding ticket or accident can add $30–$70 to your premium. A DUI can push costs into the $240s per monthIn general, safe driving habits keep your USAA monthly premium low.

-

Age and Experience: average USAA car insurance co.s Younger drivers (especially teens) cost more to insure. USAA data shows young motorists paying ~$171/mo vs seniors at $113/mo. This reflects the higher risk profile of inexperienced drivers. Conversely, mature drivers with long, clean records see big discounts.

-

Vehicle Type: High-value or powerful cars cost more to insure. A new luxury or sports car raises your coverage cost; USAA even offers additional discounts for newer vehicles (under 3 years old) because they tend to have better safety features.

-

Location (ZIP Code): Where you live impacts rates. High-traffic or high-theft areas incur higher premiums. USAA notes that parking your car on a military base (if available) can save up to 15%In general, urban areas and states with higher claim costs (e.g. Florida, Louisiana) drive up premiums.

-

Credit History: In most states, a credit score affects the price. USAA’s data shows drivers with poor credit pay ~$209/mo, versus ~$117/mo for good credit. Keeping a strong credit profile helps lower your USAA insurance cost.

-

Coverage Choices: Deductibles and coverage limits matter. Higher limits and lower deductibles mean higher premiums. For example, Policygenius found increasing liability limits from $50K/$100 to $100K/$300 raised USAA’s average premium from $1,044/yr to $1,191/yr.

-

Annual Mileage: Driving more miles increases risk. USAA offers an annual mileage discount for those who drive below a certain threshold. If you drive less, your average USAA premium will be lower.

Each of these factors can add or subtract from the average USAA car insurance cost. The best way to estimate your premium is to get a personalised quote. But as a rule of thumb, maintaining a clean record, good credit, and low mileage will yield the cheapest USAA rates.

To see how rates stack up, imagine two drivers: a safe 40-year-old and a new teen. The mature driver might pay around $113–$125 per month for full coverage (clean record, standard car A 16- or 17-year-old could easily pay $300 or more per month for the same coverage. Gradually, as young drivers gain experience and discounts (good student grades, defensive driving), their USAA insurance costs can drop significantly. Always ask USAA about any driver-on-policy discounts (e.g. good student) to lower the bill.

USAA Insurance Discounts & Savings?

USAA offers a rich set of discounts that can dramatically cut your premium. Key discounts include:

-

Multi-Policy (Bundling) Discount: Save up to 10% by insuring multiple policies (auto + home/renters) with USAA. Bundling is one of the easiest ways to lower your USAA monthly premium.

-

Safe Driver Discount: Good drivers (no accidents or violations for 5+ years) earn a safe-driver discount

-

Good Student Discount: Full-time students under 25 with a 3.0+ GPA can save on their USAA auto insurance

-

New Car Discount: Insuring a new vehicle (model <3 years old) may qualify you for a discount

-

Anti-Theft Devices: If your car has alarm systems or GPS trackers, USAA rewards you with savings

-

Mileage Discounts: Driving fewer than the average miles per year triggers a discount

-

Payment & Setup Discounts: Paying in full or setting up automatic payments can save a few percen Unlike many insurers, USAA doesn’t charge fees for paying monthly; in fact, they offer an automatic payment discount (about 3%

-

Military Base Discount: Stationing on base can cut your premium by up to 15%

-

USAA Family Discount: If you grew up with parents who had USAA, you may get a loyalty discount (up to 10%) when you set up your own policy.

-

USAA SafePilot: This usage-based program monitors driving habits via a smartphone app. Safe-driving participants can save up to 30% on their premiumsTaking advantage of these discounts is crucial. For example, if you bundle auto with homeowners and qualify for a good-driver and safe-pilot discount, your average USAA car insurance cost could drop by 20–30%. Always ask a USAA rep to review which discounts you qualify for.

USAA Coverage Options & Monthly Premiums?

USAA’s base car insurance plans cover the usual liability, collision, and comprehensive options. You can customise coverage levels, deductibles, and add-ons like rental reimbursement or gap insurance. (USAA offers Guaranteed Asset Protection (GAP) for financed cars, which isn’t included by default.

Generally, higher coverage raises the USAA insurance price. For instance, bumping liability limits or adding full glass coverage will increase your cost, while raising your deductible lowers it.

USAA allows flexible payment schedules. A full-coverage policy might cost ~$117/month as noted, but you can pay annually, semi-annually, or monthly with no extra fees. Average USAA car insurance cost

. This means you can choose a plan that fits your budget. The “Average USAA car insurance cost” often quoted (e.g. $87–$125/month) assumes standard coverages and a reasonably low deductible. If you want cheaper premiums, you can drop to state minimum liability; USAA’s minimum coverage policies averaged only $35 per month in one analysis. However, note that minimum plans offer far less protection (only basic liability) and may not be adequate for all drivers.

USAA vs. Other Insurers?

USAA’s exclusivity (military membership only) often means it can offer lower rates. In side-by-side comparisons, USAA consistently beats major insurers on price. For example, NerdWallet’s data (above) showed USAA at $125/mo vs. $143 for Travellers or $165 for GEICO.

Similarly, a Bankrate study (2025) found USAA’s average rate well below the national benchmark. In practice, many USAA members report saving hundreds of dollars per year by switching to USAA from carriers like GEICO or Allstate.

That said, USAA and its peers all calculate rates differently, so it pays to shop around. If you’re eligible for USAA, getting a quote from them is often a smart first step. But also compare with other insurers: sometimes a non-military company may still be competitive, especially if you have unusual risk factors. The table above gives a snapshot.

You can see that USAA’s average full-coverage rate is markedly lower in the typical profile. For liability-only coverage, USAA is also very low (about $32 per month), though companies like GEICO may be comparable on just minimumsAveragege USAA car insurance cost

How to Lower Your USAA Premium: minimise the?

-

Maintain a Clean Record: Avoid accidents and tickets. Even a single speeding ticket can raise your premium by ~$30/month. Defensive driving courses might also earn a small discount.

-

Improve Credit: In states where it applies, a better credit score can mean cheaper rates.

-

Increase Deductibles: Raising your collision/comprehensive deductible (e.g. from $500 to $1000) lowers your premium, but be sure you can afford the higher deductible in a claim.

-

Enrol in SafePilot: If available in your state, the SafePilot app can automatically give you a 10% discount for just signing up, with up to 30% savings for excellent driving.

-

Take Advantage of Bundles: As noted, bundling auto with home/renters (especially through USAA) is one of the biggest savings moves. If you qualify for discounts like good-student or military base parking, be sure to claim them. Average USAA car insurance cost

-

Choose the Right Car: When buying a vehicle, consider how insuring it will affect your budget. Provide information on vehicle safety and theft rates; generally, a car with top safety scores and low theft risk is cheaper to insure.

-

Regularly Shop Your Rate: Even after you enrol, check every year if USAA still has your best deal. Sometimes USAA will raise rates with no incident (common in 2024-25 due to inflation and claims trends, so re-quoting after any major life change can pay off.

Pros & Cons of USAA Car Insurance?

Pros:

-

Very Competitive Rates: USAA’s average premiums are among the lowest available. Many military families report saving on average ~$725 per year by switching to USAA.

-

Excellent Financial Strength: USAA has top financial ratings (A++ from AM Best) and scored 890/1000 in J.D. Power claims satisfaction (2022, indicating reliable claims-paying ability and service.average USAA car insurance cost

-

Rich Discounts: USAA offers a wide range of discounts (student, multi-vehicle, multi-policy, etc.) that few competitors match.

-

Service & Technology: USAA’s mobile app and digital tools are highly rated, making it easy to manage your policy, file claims, and pay premiums (second-highest J.D. Power digital experience score

-

Specialised Perks: Options like gap insurance, roadside assistance, and storage discounts for deployed members add value beyond just a basic policy

Cons:

-

Membership Eligibility: Only military members, veterans, and their families can join, so it’s not an option for the general public.

-

Claims Communication: Some customers report slower or less communicative claims handling (a known drawback per The Zebra’s review

-

Limited Local Presence: USAA relies on phone and digital service rather than local agents, which may not suit everyone’s preferences.average USAA car insurance cost

-

Fewer Non-Military Discounts: While USAA has many discounts for military and student life, it lacks some regional or professional-affiliation discounts that other insurers might offer.average USAA car insurance cost

Key Insights

-

USAA is unusually cheap: Full-coverage premiums often run under $125 per month, versus ~$220 national average. Liability-only plans can be as low as ~$30/mo.

-

Young drivers pay more: Teen rates are high (often $200+ per month), while experienced drivers with clean records get steep discounts.s

-

Driving history matters: Even one speeding ticket or accident can raise your USAA rate by $30–$70 pemonthhA A DUI roughly doubles it. Maintaining a clean record is the fastest way to keep costs down.

-

Discounts add up: USAA’s discounts bundling, good student, base parking, SafePilot, etc.) can cut your premium by 20–30%. Always ask which ones apply to the average USAA car insurance cost.t

-

Premium vs Coverage: Expect to pay ~$1,100–$1,500 per year for full coverage, depending on coverage limit. Minimum coverage is far cheaper (~$417/year). Consider how much coverage you truly need.

-

Compare quotes annually: Even as a member, shop around. USAA is often cheapest, but rate hikes affect everyone. Use USAA as a baseline and double-check competitors if your renewal jumps unexpectedlyAveragege USAA car insurance cost

Frequently Asked Questions

Q1: What is the average USAA car insurance cost in 2025?

A: USAA’s average cost depends on coverage, but full-coverage policies typically run about $1,100–$1,500 per year (roughly $90–$125 per month.

This is significantly below the national average. Liability-only (minimum) coverage might average only $400–$500 per year (~$30–$40 per month. Your exact premium will depend on your car, location, and profile.

Q2: How much is USAA car insurance for a young driver?

A: Young or novice drivers usually face higher rates. USAA data shows a clean-teen driver pays around $2,048 per year ($171/mo for full coverage.

Completing driver’s ed or maintaining good grades can earn discounts. It’s often cheaper to stay on a parent’s policy as a teenager.

Q3: Are USAA car insurance rates cheaper than average?

A: Yes. USAA’s rates are among the lowest nationwide. For example, one analysis found USAA’s 6-month full-coverage rate was ~$835 vs $1,084 nationally. Industry studies repeatedly rank USAA as one of the cheapest companies for qualified drivers average USAA car insurance cost.

Q4: What factors affect USAA car insurance premiums?

A: The same factors that affect all insurers: your driving record (accidents/tickets raise rates), age, credit score, vehicle type, location, and coverage choices. USAA also considers military status (active duty vs. reserve.

Low mileage and bundling with other USAA policies can lower premiums. Uncontrollable factors (weather/climate claims in your area) can also indirectly impact USAA’s rates. Average USAA car insurance cost

Q5: What discounts does USAA offer on car insurance?

A: Many discounts.The average USAA car insurance cost. Key ones include multi-policy (bundling auto + home/renters), good student (for full-time students with a GPA ≥3.0), safe driver (clean record for 5+ years), new car/new safety features, anti-theft devices, and the SafePilot usage program up to 30% off.

There’s also a military-base parking discount (up to 15% off) and an automatic-pay discount. Combining multiple discounts can substantially reduce the.

Summary

In 2025, the average USAA car insurance cost remains very competitive, especially for eligible military-affiliated drivers. Expect to pay roughly $1,100–$1,500 per year for full coverage (around $90–$125 per month). Factors like age, driving history, and coverage level can raise or lower your premium. USAA’s deep discounts (bundling, good student, SafePilot, etc.) can knock large chunks off the price.

Overall, USAA often undercuts major insurers, but it’s limited to military members and families. If you qualify, a USAA policy is hard to beat on price and service. Be sure to compare coverages, lock in available discounts, and review your USAA premium annually to keep your auto insurance costs as low as possible. Average USAA car insurance cost