Getting Car insurance price quotes online has become the norm for savvy drivers. With premiums up (full-coverage rates rose ~42% from 2022 to 2024, almost 39% of drivers feel they overpay for insurance. The good news is that free online tools let you compare rates 24/7.

In this article, we’ll explain precisely what online car insurance quotes are, review major coverage types, and show you how to find cheap quotes by comparing providers. We’ll also list the top U.S. insurers for 2025 and answer common FAQs about getting quotes online.

Online quotes are quick estimates of what your car insurance would cost. Major insurers (and comparison sites) let you enter driver, vehicle, and coverage information to get an instant online price quote. These quotes are free to call and help you compare multiple offers in minutes.

Whether you use a site like Policygenius or The Zebra, or go direct to companies (GEICO, State Farm, etc.), you can shop for insurance at your convenience. This guide covers the essentials of Car Insurance Price Quotes Online and how to use them to save.

What are Car Insurance Price Quotes Online?

A car insurance quote is simply an estimate of how much an insurance policy would cost you. It’s determined by your personal details, driving history, age, credit, and the vehicles you insure. When we say ‘price quotes online,’ we mean getting these estimates online. In practice, you fill out a form with your ZIP code, driver’s license info, vehicle make/model, etc., and the insurer (or comparison site) runs a quick rating.

Key points: Online quotes are free and as safe as talking to an agent. Comparison sites like The Zebra or Policygenius show side-by-side quotes from many companies, so you can quickly find the lowest rate for your coverage needs. Because online shopping is fast, many drivers compare quotes every 6–12 months. As one insurer’s site explains, “you should compare car insurance quotes every six months” to lock in the best deal.

In short, Car Insurance Price Quotes Online are online tools that estimate your premium. Using these quotes, you can adjust coverages and shop around without ever picking up a phone.

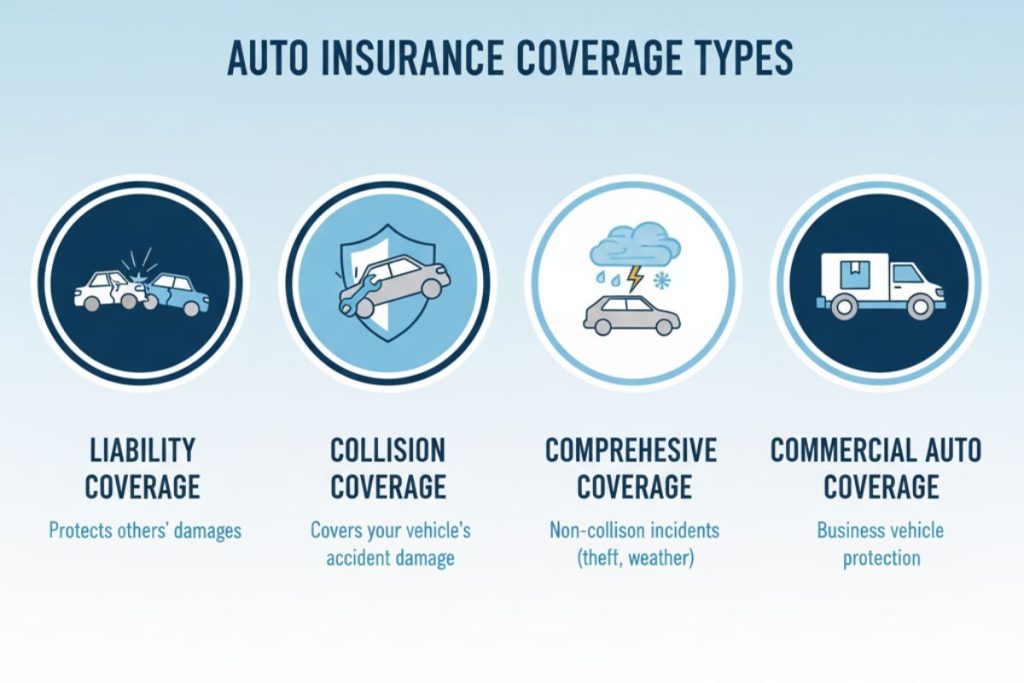

Types of Car Insurance Coverage in the USA

Auto policies typically include several coverage types. Understanding these helps you compare quotes apples-to-apples. Below are the main coverage categories in U.S. car insurance:

Liability Coverage

Liability coverage is required in nearly every state. It pays for other people’s damages when you’re at fault in an accident. That means medical bills or vehicle/property repairs for the other party. It does not pay to fix your own car or cover your medical costs – those costs require collision, comprehensive, or personal injury coverage.

State law mandates liability minimums (e.g., 25/50/25), and insurers quote this coverage as part of your policy. For example, King Price offers online quotes for liability auto insurance – you can see how your King Price car insurance online quote changes with different limits. Car insurance price quotes online.

Liability insurance is split into property damage (repair to other people’s cars and fences) and bodily injury (medical bills for others). The safest approach is to get a quote with higher liability limits if you can afford them, since a severe accident could exceed the limits of lower limits.

Collision Coverage

Collision coverage kicks in when your car collides with another vehicle or object. In other words, it pays to repair or replace your vehicle after an accident you cause or if someone hits you. Collision is optional unless you finance/lease the car (then it’s usually required). When shopping online, you’ll choose a deductible (often $500 or $1000), and companies will quote how much more you pay for a lower deductible. Car insurance price quotes online.

Collision quotes can vary widely, so comparing for the cheapest online price is smart. For instance, some drivers search specifically for the most affordable online car insurance quote by adjusting coverages or using discount codes. Remember: collision will cover your damages regardless of fault, but won’t pay damage you cause to others (that’s liability’s job). Increasing your deductible is a common way to lower collision premiums when getting quotes.

Comprehensive Coverage

Comprehensive coverage (aka “other than collision”) pays for losses not involving a crash. Think of theft, vandalism, flood, fire, falling objects, hail, or hitting an animal. For example, if your car is stolen or a tree limb falls on it, comprehensive insurance covers the repairs (minus your deductible). Car insurance price quotes online.

Comprehensive is also optional, but lenders often require it on financed cars. When comparing quotes online, you’ll notice that comprehensive and collision coverage are usually combined as “full coverage.” Many websites let you quickly compare car insurance prices with fast online quotes, allowing you to adjust whether you include comprehensive coverage.

A key tip: if your car is older/low-value (say <$4,000), many drivers skip comp and collision to save money, since repair costs might exceed the car’s worth. But if your car is newer or you can’t afford to replace it out of pocket, include comprehensive in your online quote search.

Commercial Auto Coverage

Commercial auto insurance covers vehicles used for business, including company cars, trucks, and vans. Personal auto policies usually exclude business use, so commercial policies fill the gap. They include liability, collision, comprehensive, and often extras like medical payments or hired auto coverage.

For example, Progressive explains that “commercial auto insurance covers liability and physical damage for business vehicles, such as cars, trucks, and vans”. Small businesses that deliver goods or transport people need it. When you get an online quote for a business vehicle, you’ll specify that it’s for business use. Some tech-forward insurers even let small business owners get a quick quote online. Car insurance price quotes online.

(Note: Consumers sometimes search for a king price car insurance online quotes in general, though King Price is not available for U.S. business fleets. In the U.S., carriers like Travelers or Progressive are more common for commercial policies.) Car insurance price quotes online

Key Takeaway: Liability covers other people’s damage/injury; collision covers damage to your car after a crash; comprehensive covers non-collision losses; commercial covers business vehicles. Always match the coverage limits when you compare quotes.

How to Find Cheap Car Insurance Price Quotes Online in the USA?

Shopping smart can slash your premiums. Here are proven strategies to get cheap online quotes:

- Compare Quotes from Multiple Insurers. Don’t settle on the first price. Use comparison sites or insurer tools to get at least three quotes. Each company weighs factors differently, so one may quote you much cheaper than another. For example, Policygenius and The Zebra let you enter your info once and view many quotes side-by-side. AARP recommends switching if you find a lower quote – consumers who switched saved a median $461 per year

- Use Discounts. Virtually all insurers offer discounts. Key ones include: good driver (clean record), multi-car, multi-policy (bundle auto+home), paperless payment, and safety features. The Zebra lists standard discounts like auto-pay, safe driver programs, multi-vehicle, and “telematics” usage-based programs. For example, many companies offer 5–10% off for enrolling in automatic payments or paperless billing. Car insurance price quotes online. Anti-theft devices (alarms, tracking) can reduce rates by 5–20%. Bundle your car with home or renters insurance for significant savings – insurers report bundling saves on average ~10–20%. Check for special programs too (good-student, mature-driver courses, military/AARP membership). When getting an online quote, make sure to tick all discount boxes – they may be applied automatically. Car insurance price quotes online.

- Raise Your Deductible. A higher deductible means a lower premium. If you can afford a $ 1,000 deductible instead of $500, your premiums drop. The Zebra notes that collision and comp premiums trade off with deductibles. Experiment in quotes: see how your price changes as you bump up the deductible.

- Maintain a Clean Record and Good Credit. Car insurance price quotes online. Safe driving (no accidents/tickets) and good credit history earn lower rates. Many insurers include “good driver” discounts if you’ve been violation-free for years. Some even use telematics apps (like Progressive’s Snapshot or State Farm’s Drive Safe & Save) to reward actually safe driving. If offered, it can cut your quote if you drive carefully.

- Shop Periodically. Insurance rates change. Every 6–12 months, restart the quote process. Life events (a move, a new car, a marriage) often lead to lower rates. Even without changes, companies adjust rates yearly, so checking again can reveal a cheaper quote. Remember to compare the same coverage levels.

Here’s a quick checklist: Car insurance price quotes online

- Enter identical coverage limits across quotes (so you compare apples to apples).

- Use online aggregators for speed (some let you compare car insurance prices with fast quotes online).

- Read each quote’s details (coverage, term) – the cheapest price might not be full coverage.

- Look for promo codes or special offers (e.g., student, military, Car insurance price quotes online, occupational discounts).

- If you can, pay annually instead of monthly to avoid financing fees on the premium.

By blending these tips, many drivers see significant savings. For example, if your quote is high, ask the insurer about missing discounts – one driver found a larger good-student discount just by calling. And if you find a competitor’s quote that’s cheaper online, don’t hesitate to switch: insurance can usually be canceled easily, and the old premium can be refunded.

Insider Tip: Some sites let you enter your ZIP code and instantly see rate estimates by company. This “get price quote online car insurance” feature gives a ballpark in seconds. It’s a great way to see who offers the cheapest online price before submitting full info to multiple carriers.

Best Companies Offering Car Insurance Price Quotes Online in 2025?

Many insurers now provide instant online quotes. Here are seven notable companies (and one innovative insurer) known for online quoting and value:

- Travelers – Travelers tops many “best of” lists for value and coverage. Their website lets you get quotes quickly, and they offer numerous discounts (e.g., for long-time customers, safety features, and usage). NerdWallet notes Travelers as #1 for affordable rates and strong discount programs. Car insurance price quotes online.

- State Farm – The nation’s largest insurer (16–17% market share). State Farm offers an easy online quote tool and mobile app. Customers get a personal agent, too. On average, State Farm policyholders pay about 18% less than the typical major insurer. It’s known for excellent customer service scores and a broad agent network.

- GEICO – Famous for low rates and online convenience. GEICO ranks among the cheapest insurers for many drivers. Their website and app let you get quotes in minutes. The average GEICO policy is about $100 per month (well below many competitors). They also have strong financial stability.

- Progressive – Car insurance price quotes online. Third in size, Progressive pioneered online quoting. Tools like “Name Your Price” and Snapshot usage-based discounts started here. Progressive’s quotes tend to be slightly above average, but it offers a lot of flexibility (e.g., bundling and pay-per-mile options via Metromile). They let you get quotes online or through an agent.

- All states (including Esurance). Allstate is one of the biggest brands. Their online quote portal is simple to use. Allstate rates are typically higher than average —about $41/month more on an average policy —but they offer excellent agent support and many discounts (Drivewise safe-driving program, multiple policies, etc.). Esurance (owned by Allstate) provides a fully online quoting experience without agents. Car insurance price quotes online.

- USAA – Only for military members and families. However, it’s worth mentioning that USAA consistently has the lowest average rates for qualified drivers (about $90/month in a recent sample). Their online quote system is user-friendly. If you’re eligible, get a USAA quote; it might be the cheapest you’ll find. (NerdWallet notes USAA’s full-coverage rate as ~$125/month vs $192 avg).

- King Price (South Africa). Although not a U.S. company, King Price is noteworthy for innovation in online quoting. They advertise “get a quick, personalized quote online in just a few clicks”. King Price’s model includes decreasing premiums as your car ages, which is unique. If you ever need a perspective, you can try their quote tool (note: it currently quotes only in South Africa). We mention it here to show how online quoting can work and to include King Price car insurance online quotes in our discussion, as some consumers search for them. Car insurance price quotes online.

Each of the above insurers (except King Price) provides free online quotes on their websites or mobile apps. When using their quote tools, you’ll see coverage options and can often tweak deductibles and limits to meet your needs. The more accurate info you supply, the more precise your quote will be.

FAQs About Car Insurance Price Quotes Online?

Q1: What is a car insurance price quote online?

A: A car insurance price quote online is an estimated premium you get from an insurer via the internet. It’s based on your profile (age, car, driving history, location, coverage choices). Essentially, it tells you “how much you’d pay” for a policy before you buy it. Car insurance price quotes online

Online quotes are typically free. For example, The Zebra defines a quote as “an estimate of what you can expect to pay for insurance coverage from a specific company”. When you get a quote online, you might receive it instantly or have an agent follow up. It’s a snapshot based on the info you provided.

Q2: How do I get a King Price car insurance online quote?

A: King Price is a South African insurer (not currently in the U.S.), but its process is illustrative. On their site, you click “Start Online Quote” and enter your information. They promise a “quick, personalized quote online in just a few clicks”.

For U.S. drivers, this means using similar quick-quote buttons on U.S. insurer websites. In general, you visit an insurer’s site (or a comparison site) and follow the prompts to get an online quote. King Price’s example shows that even internationally, the process is the same: supply details and get a price.

Q3: How can I find the cheapest car insurance quote online?

A: To get the cheapest online price quote, compare companies! Use a site like Policygenius or NerdWallet to request multiple quotes at once. When you have several quotes, look for the lowest premium for the same coverage. Also, ensure you’ve claimed all discounts. Sometimes you’ll see one company offer a significantly cheaper online quote

. According to NerdWallet and AARP experts, getting at least three quotes is key to finding the best deal. Adjust coverages (like raising your deductible) and immediately see which quote comes out lowest. In short, the cheapest online quote is usually found by thorough comparison. Car insurance price quotes online

Q4: How can I compare car insurance prices using fast online quotes?

A: Use comparison marketplaces or insurer websites. For example, Car insurance price quotes online (Policygenius or The Zebra) let you enter your info once and see fast, side-by-side quotes from dozens of insurers. If you prefer individual sites, note down one insurer’s quote (e.g., GEICO), then immediately try another (e.g., Progressive) and compare the results. Car insurance price quotes online

Advanced tools will match coverage, deductibles, and terms to give you the big picture. The advantage of online quotes is speed: many sites literally give you a price after a few minutes of entering data. That lets you quickly compare rates and find the best one without retyping the info.

Q5: Where can I get a car insurance price quote online?

A: Practically all major U.S. insurers offer online quotes. Companies like GEICO, State Farm, Progressive, and Allstate, among others, have user-friendly “Get a Quote” sections on their websites. In addition, independent comparison websites (e.g., Policygenius, The Zebra, Insurify) provide price quotes from multiple insurers after you fill out one form. Car insurance price quotes online.

If you enter your ZIP code on sites like NerdWallet, they may show “average rates in your area” as a starting point. But for a precise price quote for online car insurance, go to an insurer’s site or use a trusted quote aggregator.

All you need is basic info (driver age, car model, coverage desired) to get started. Necessary: Make sure any quote request is made through a secure, legitimate site. If in doubt, stick to well-known companies or comparison platforms.

Conclusion

Car insurance price quotes online make shopping for auto coverage faster and easier than ever. By understanding your coverage needs (liability, collision, comprehensive, etc.) and using online tools, you can find quotes tailored to your situation. Always compare multiple quotes to get the best deal.

As AARP and insurance analysts note, switching carriers after getting quotes can save hundreds annually. Remember to leverage discounts (good driver, bundling, telematics) and consider raising deductibles to lower your premiums.

To recap, we covered:

- What an online quote is: a free estimate of your premium.

- Coverage types: liability, collision, comprehensive, commercial, with key definitions

- Cheap quote tips: compare quotes often and use discounts

- Top companies: major carriers that make quoting easy (e.g., Travelers, State Farm, GEICO, USAA).

Now it’s your turn: get an online quote today! Enter your information on insurer websites or comparison tools, and you’ll quickly see how much you can save. By regularly comparing car insurance price quotes online, you take control of your coverage and budget. Compare quotes now and lock in the best rate.