Cheap Car Insurance NYC can feel expensive in 2025, but there are still ways to find affordable rates for both commercial and personal vehicles. If you live or work in New York City, finding cheap car insurance in NYC can help you save hundreds every year.

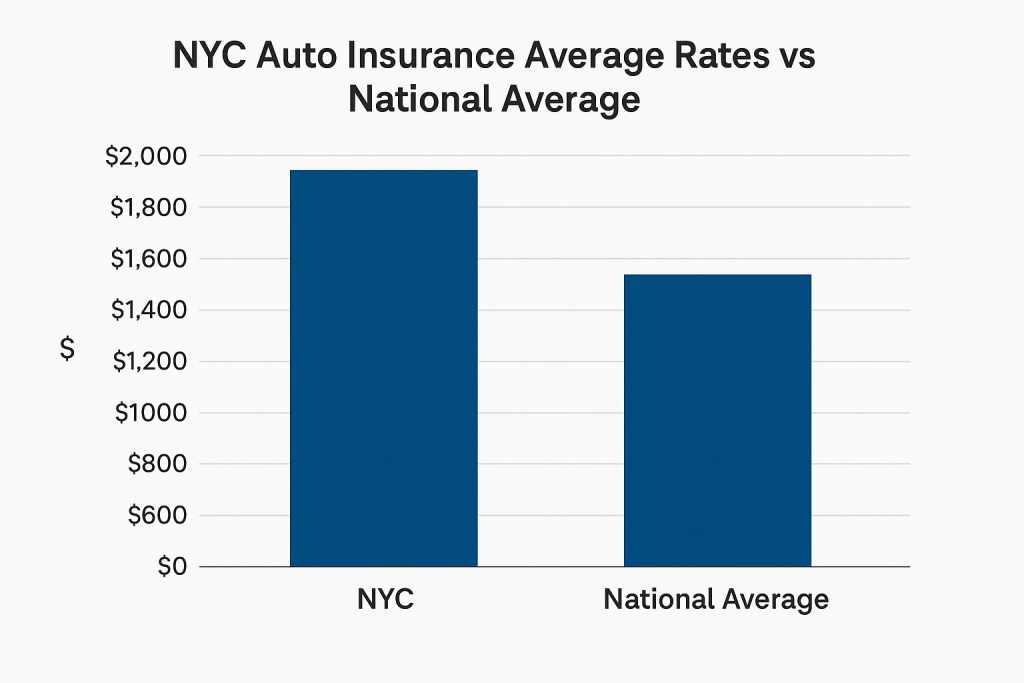

Times Square in New York City exemplifies the bustling urban environment that drives up auto insurance costs. With heavy traffic and dense population, NYC drivers face premiums well above the national average. In fact, a full-coverage policy in New York City costs approximately $378 per month on average, which is roughly twice the national average, reflecting higher accident and theft risks.

Significant factors include congested streets, high repair costs, and New York’s no-fault insurance laws (requiring Personal Injury Protection), which combine to make insurance expensive. Cheap Car Insurance NYC

Finding cheap car insurance in NYC, whether commercial or personal, in 2025, is challenging but crucial. We’ll break down how New York’s insurance market works, which coverages are required, and practical tips for finding lower rates. Whether you’re insuring a company delivery van or your family sedan, this guide explains NYC-specific regulations, compares costs with other states, and offers strategies to save on premiums. By the end, you’ll understand how to navigate insurance quotes and policies for both commercial and personal autos in New York City.

Why Is Car Insurance So Expensive in NYC?

New York is a no-fault insurance state, meaning all drivers must carry Personal Injury Protection (PIP) coverage. This legal requirement alone pushes premiums higher, since insurers must cover medical costs regardless of fault.

Cheap Car Insurance NYC Additionally, New Yorkers pay for more coverage: standard liability (25/50/10 for bodily injury/property) plus uninsured motorist and PIP coverages. High vehicle theft and dense traffic also drive up claims, adding roughly 10–15% to NYC rates as honest drivers subsidise those who register out-of-state. A Money Geek analysis found New Yorkers pay about 94% more than the national average for full coverage.

Despite New York State’s high averages, rates vary dramatically by location. ValuePenguin reports full-coverage insurance in New York City averages about $378/month, but Manhattan’s average is only ~$302, while Brooklyn’s is ~$492. This borough gap reflects different crime rates, congestion, and market competition. Regardless, NYC remains one of the most expensive metro areas: MoneyGeek notes NYC car insurance is 60–80% higher than upstate because city drivers file more claims.

State-Minimum Coverage Requirements?

All drivers (personal or business) must meet New York’s minimum liability limits: $25,000 per person and $50,000 per accident for bodily injury, and $10,000 for property damage (25/50/10). In addition, New York requires every policy to include $50,000 in Personal Injury Protection (PIP)and uninsured/underinsured motorist coverage ($25/$50k). These mandates (and recently added spousal liability coverage) exceed many states’ requirements, so even a “minimum” policy is relatively comprehensive.

For example, an insurer’s filings show NY policies typically include at least $50k PIP and $50/$100k uninsured motorist per accident Failure to maintain active insurance on a TLC (Taxi & Livery) vehicle in NYC can lead to fines or license suspension Indeed, the NYC Taxi & Limousine Commission requires licensed for-hire vehicles to carry state-minimum liability (25/50/10) and to file proof with the TLC. These strict rules and required add-ons mean even basic coverage in NYC is more expensive than in many other places.

Cheap Car Insurance NYC for Personal Vehicles?

For most drivers, “personal auto insurance” means insuring a privately owned car used for commuting or leisure. Rates depend on driver profile, vehicle, and location. Young drivers, those with tickets or accidents, and people with poor credit see the highest NYC premiums. Conversely, insurers like NYCM offer low rates for safe drivers – e.g., about $68/month for a clean-record young driver.

Drivers can shop for cheap personal coverage by comparing companies: ValuePenguin notes that Progressive, NYCM, and USAA often offer some of the lowest full-coverage quotes in New York. However, USAA is only available to military families. In NYC specifically, Progressive offers the lowest average full-coverage quote at ~$100 per month.

Tips for personal policies: Cheap Car Insurance NYC. Compare quotes online and via agents, and maintain a clean record to unlock discounts. Bundling auto with renters or home insurance can save up to ~$800/year. Also, ask insurers about safe-driver discounts or anti-theft device credits. Consider increasing your deductible ($500–$1,000) to lower your premium (but be sure you can cover it out of pocket). Usage-based (pay-per-mile) plans may also reduce costs for low-mileage drivers.

Commercial Auto Insurance in NYC?

Commercial auto insurance covers vehicles used for business. In New York, personal auto policies will not insure vehicles used for business purposes. The State of New York explicitly requires a separate commercial auto policy for any vehicle used in a business, even if already insured personally. Typical commercial vehicles include company cars, delivery vans, and rideshare or taxi fleets.

Coverage Differences for Commercial Policies?

Commercial policies bundle liability and optional coverages tailored to business use. Required Commercial Auto Liability covers legal costs if an employee causes injury or damage. Businesses often add Uninsured Motorist and Medical Payments coverage to help cover bills if their driver is injured.

They also commonly include Comprehensive and Collision to protect company vehicles from theft or crashes. Additional options include Hired/Non-Owned Auto (liability when employees drive rental/leased vehicles), Loading/Unloading liability, and roadside assistance. Cheap Car Insurance NYC

Because commercial vehicles often carry cargo or higher-value goods, premiums tend to be higher than those for personal auto insurance. Insurers rate commercial policies based on factors such as the driver’s record and vehicle type.

Larger trucks (e.g., box trucks and tractor-trailers) have higher premiums than small vans. Industries with more risk (construction, deliveries) also pay more. In short, commercial auto insurance is tailored and usually costlier; shopping around is key.

NYC-Specific Requirements and Changes?

Cheap Car Insurance NYC has unique rules for commercial for-hire vehicles. Until 2025, NYC’s Taxi and Limousine Commission (TLC) required $200,000 PIP (per person) for all taxis, Ubers/Lyfts, and livery cars – four times the rest of NY State’s $50k minimum.

In July 2025, Mayor Adams signed a law reducing TLC-required PIP to $100,000 per person. This still exceeds the statewide $50k, but is expected to lower premiums by ~15–25% for those drivers (Note: TLC rules still demand at least state-minimum $25/50/10 liability on all for-hire vehicles)

How much does commercial insurance cost? In New York State, the average full-coverage auto policy runs ~$3,433 per year. Since NYC has higher risks, commercial rates here are among the nation’s highest. Factors such as industry type and vehicle size heavily influence costs.

Businesses can save by raising deductibles, installing GPS/anti-theft devices, and maintaining driver training programs. In NYC, it’s wise to consult an experienced broker who can tailor a commercial policy to your needs and help apply discounts for multi-vehicle fleets or safety features.

Why NYC Insurance Is So Expensive?

Several city-specific factors inflate NYC premiums. According to Money Geek, New Yorkers pay 134% more than average for minimum coverage and 94% more for full coverage. The main reasons:

- No-Fault (PIP): New York’s PIP requirement forces insurers to pay medical claims regardless of fault. NYC drivers’ past $200k PIP mandate especially drove costs up until 2025’s reform.

- Accidents & Traffic: NYC has a very high traffic density. A 2024 NY State Comptroller report cited a ~26% rise in traffic fatalities statewide. More accidents and congestion translate to more claims.

- Theft and Vandalism: Urban crime rates raise premiums. For example, NYC’s violent crime rate is higher than 97% of U.S. cities, meaning insurers pay more theft and damage claims. Cheap Car Insurance NYC

- Severe Weather: Big snowstorms and hurricane threats in the region increase the risk of accidents and damage. Insurers build this risk into NYC rates.

- Fraud and Legal Costs: Past high PIP levels (especially $200k in NYC) led to more lawsuit fraud. This, plus high legal fees in NYC, pushes prices up.

- Healthcare Costs: New York’s medical costs are ~37% above the national average, so injury claims cost more, which raises everyone’s premiums.

In short, NYC drivers pay more because they are statistically more likely to file expensive claims. Even safe drivers end up subsidising higher-risk policies. (Notably, upstate New York is much cheaper: average upstate rates are 60-80% lower than NYC, partly because NYC’s costs are pooled across the state.)

How to Find the Best Cheap Car Insurance NYC Deals?

Despite high rates, drivers and businesses can employ tactics to save on NYC insurance. Here are proven strategies (source: MoneyGeek):

-

-

- Compare Multiple Quotes: Shop around. Insurance rates vary widely between companies. Use online comparison tools or work with an independent agent to get several quotes. Do not default to one insurer.

- Bundle Policies: Many insurers offer steep discounts if you buy auto insurance along with home or renters insurance. If you need both, bundling can save hundreds of dollars per year.

-

-

-

- Use All Discounts: Inquire about every discount you may qualify for: safe-driver/mature-driver discounts, multi-car discounts, anti-theft device credits, defensive driving course credits, and good student discounts if applicable.

- Raise Your Deductible: Cheap Car Insurance NYC A higher collision/comprehensive deductible (for example, $1,000 vs. $500) can significantly lower your premium. Just ensure you have the savings to cover the larger deductible if you ever file a claim.

- Pay-Per-Mile or Usage-Based Plans: If you drive infrequently, consider a usage-based plan or a pay-per-mile program.m These can cut costs for low-mileage drivers by tying the premium more closely to actual driving.

- Maintain a Clean Record: Avoid tickets and accidents. Even one speeding ticket can raise the NYC rate by ~16%. A clean driving record and good credit history can qualify you for the lowest rates.

- Consider Company Reputation: Some insurers, such as Progressive and NYCM, consistently offer low NYC quotes. Check ratings (J.D. Power, AM Best) – for example, NYCM has high customer satisfaction and low rates.

-

By combining these tips, especially quote shopping and taking advantage of discounts, many New Yorkers reduce their premiums well below the local average. One quick way to compare rates is to use an online marketplace that includes major carriers.

Comparing NYC to Other States?

Many drivers search for “cheap Florida car insurance” or “cheap car insurance in KY” out of curiosity or before relocating. How do those states compare?

- Florida: Florida is notoriously expensive. NerdWallet reports Florida’s average full-coverage premium at ~$3,691/year (about $308/month). By comparison, New York State’s average is ~$2,608/year. So NYC is pricey, but Florida (with a large population and past storm claims) is even more expensive.

- Kentucky (KY): Kentucky’s average full coverage is about $3,067/year, higher than New York’s average. Budget carriers (e.g., GEICO, State Farm) often target Kentucky with low quotes, but drivers there still usually search for “cheap car insurance in KY” due to rising rates. Cheap Car Insurance NYC

- Maryland: Maryland drivers pay roughly $2,748/year for full coverage, slightly above New York’s $2,608. Marylanders may look for “cheap car insurance Maryland” deals, but again, NYC’s urban risks keep its rates competitive with, or higher than, many East Coast states.

- Other States: Nationwide, some states (e.g., Louisiana and New Jersey) cost more than New York, while places like Vermont and New Hampshire are much cheaper. NYC’s costs are among the highest in the country for urban drivers. Cheap Car Insurance NYC

Key takeaway: NYC insurance is expensive, but Florida and Louisiana often rank among the highest in premiums. If you move from NYC to KY or MD, you might see lower rates (KY ~$256/month, MD ~$229/month full coverage), especially if you maintain a clean driving record. However, remember that moving out of state has its own costs (registration, licensing, etc.), and keeping a non-NY registration in NYC illegally can result in penalties.

Engaging with This Guide?

Finding cheap car insurance in NYC—commercial coverage or budget-friendly personal policies — requires effort, but you don’t have to go it alone. Use this guide as a checklist:

- Compare quotes from multiple companies. Free online tools can save time.

- Ask insurers about the discounts you qualify for (good driver, multi-policy, anti-theft, etc.).

- Adjust coverage smartly – don’t pay for add-ons you don’t need, but ensure you meet state law and TLC requirements.

- Consult a local agent or broker who knows NYC regulations and can navigate for-hire vehicle rules or business policy bundles.

If you have experience with NYC auto insurance, please share your tips in the comments or on social media! Engaging with others can surface new ideas or recommend trusted insurers. Remember, the cheapest policy isn’t worth having if it leaves you underinsured. Focus on tailored coverage that meets NYC standards while taking advantage of any savings opportunities.

Conclusion

Securing cheap car insurance in NYC, commercial or personal, in 2025 is challenging but doable with the right approach. NYC’s high rates stem from dense traffic, strict no-fault laws, and high claim costs. Businesses must carry special commercial policies, and for-hire drivers face unique rules (recently relaxed from $200k to $100k PIP). To find savings, diligently compare quotes, use all available discounts, consider higher deductibles, and possibly explore pay-per-mile plans.

Finally, shop around early. Auto insurance rates can jump at renewal, so start comparisons several weeks before your policy expires. By being proactive, bundling policies, cleaning up your driving record, or even participating in usage-tracking programs, you can significantly cut your costs.

Stay informed, ask questions, and use tools (and local agents) to your advantage. Cheap car insurance NYC Commercial coverage won’t just drop into your lap, but armed with these facts and strategies, you can secure the best possible deal in the City that never sleeps. Drive safely, and save smartly!

FAQs

- Q: Why is car insurance so expensive in NYC?

NYC drivers pay among the nation’s highest rates due to its no-fault insurance laws, high medical/repair costs, traffic congestion, and crime rates. New York also mandates coverages like $50k PIP and uninsured motorist protection. All these factors, combined with past insurance fraud issues, mean even minimum policies cost more than in many other states. (Nationwide, NY drivers pay roughly 94% above-average for full coverage.

- Q: How can NYC businesses get cheap commercial auto insurance?

Businesses should compare quotes from insurers specialising in commercial auto. Even if you own the vehicle personally, NY law requires a separate commercial policy for business use.

To reduce premiums, consider multi-vehicle discounts, fleet programs, and safety incentives (such as telematics or driver training). Raising deductibles and maintaining good driving records across your drivers also helps. For for-hire vehicles, note NYC’s new law: PIP liability is now $100k per person, which may lower rates. Talk to a broker familiar with NYC-TLC regulations to ensure compliance and find competitive quotes.

- Q: What coverages are required for NYC auto insurance?

By law, every NYC driver needs at least liability insurance with limits of 25/50/10 (i.e., $25k per person/$50k per accident bodily injury, $10k property damage).

In addition, policies must include $50,000 personal injury protection (PIP) and $25k/$50k uninsured motorist protection. Commercial vehicles may need higher limits depending on use. For taxis and rideshare, the TLC requires the same 25/50/10 minimum plus state-mandated coverage.s

- Q: How do NYC insurance rates compare to Florida or Kentucky?

Florida and Kentucky currently see higher average premiums than New York State. For example, Florida’s average full-coverage cost is about $3,691/year, and Kentucky’s is $3,067/year, both above NY’s $2,608/year. This is why Florida drivers often look for “cheap Florida car insurance.”Cheap Car Insurance NYC

Even Maryland averages ~$2,748/year. In short, NYC’s rates are high due to city factors, but Florida and some southern states can be even more expensive. Always compare rates by City and state when considering a move or multi-state coverage.

- Q: What is the cheapest way to buy NYC auto insurance?

The most reliable method is to get quotes from multiple carriers. Use online aggregators and direct insurer quotes, but also call independent agents who can quote many companies.

Weigh each quote against your coverage needs. Cheap Car Insurance NYC. If you only need basic liability, look specifically for “minimum coverage” options (NYCM Insurance has been noted as low-cost for liability). For complete coverage, Progressive and similar large insurers often offer competitive rates. Always confirm each policy meets NYC’s legal requirements (liability, PIP, etc.) before choosing the lowest price.